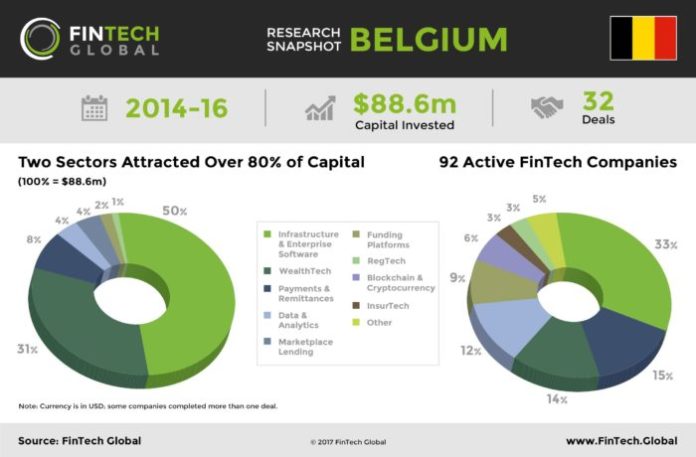

The Belgian FinTech sector is gaining impressive traction, raising nearly $90m over 32 deals in the last three years.

Belgium is establishing itself as a significant player in the European FinTech space – favourable investment environment, international talent pool, central European location, as well as being a home to key financial utilities such as SWIFT and Euroclear. In addition, the Ministry of Finance has made the development of a vibrant FinTech ecosystem in the region its priority and as a result the country is attracting increasing amounts of capital to the sector.

Belgian FinTech startups have attracted $88.6m across 32 deals since 2014. Last year a record $65.4m was allocated to the sector. The biggest three deals in that period were all closed in 2016 raising over $40m. For instance, TopCompare.be fetched €20m from Nova Founders Capital, Peter Thiel, SBI Holdings and others. The second biggest deal raised half as much with IbanFirst, a financial services platform for SMEs, collecting €10m from Xavier Neil (Founder at Kima Ventures) and other investors. The top three was rounded off by UnifiedPost, an enterprise software provider, raising €10m from SmartFin Capital and existing investors.

The sub-sectors in FinTech that closed the most deals in 2016 were Infrastructure & Enterprise Software and Payments & Remittances with 13 and 7 transactions, respectively. Over three years, however, Infrastructure & Enterprise Software and WealthTech attracted over 80% of the total amount invested in the country. The growth in number of investments was led by three investors – SmartFin Capital, Pamica NV and AAA Find – which participated in 31.3% of deals during that period.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2017 FinTech Global